Eric, Author at Ayali Pay - Simple. Quick. Smart. - Page 3 of 3

Payroll errors in Canada are more common than you think, and they can cost businesses dearly. These mistakes can lead to unpaid wages, employee lawsuits, government penalties, and a damaged reputation. In Ontario alone, employers owed a total of $60 million in unpaid wages between 2017 and 2024 that the government couldn’t collect.

The true cost of payroll mistakes goes far beyond dollars and cents. Below, we explore real-world case studies—many close to home in Canada—where payroll errors led to legal, financial, or reputational fallout. Each example also shares lessons on how to prevent the same from happening to you.

Case Study 1: The Phoenix Pay System Disaster (Federal Government of Canada)

One of the most infamous payroll errors in Canada wasn’t at a private company at all, but within the federal government. The Phoenix pay system, launched in 2016, was meant to streamline federal payroll. Instead, it turned into a colossal debacle. The system suffered hundreds of thousands of payroll errors, from employees being underpaid or not paid at all to others being overpaid by mistake. In fact, an estimated 62% of federal workers experienced pay errors under Phoenix.

The consequences were devastating. Some public servants drained their savings or maxed out credit cards while waiting for their missing pay. One Canadian Revenue Agency employee even saw her paycheques drop to $0 due to false “overpayment” deductions—she ultimately defaulted on her mortgage and lost her home as a result.

The financial cost to taxpayers has been enormous. The government has spent years and billions of dollars trying to fix Phoenix. As of mid-2024, the federal government had incurred about $3.7 billion in costs coping with the Phoenix fiasco. This includes hiring extra staff and technical support to sort out the mess.

On top of that, Ottawa has paid roughly $711 million in compensation to employees for stress, hardship, and other damages caused by the pay errors. Each affected worker was offered a lump sum for pain and suffering. Multiple audits and parliamentary inquiries were launched to understand how things went so wrong.

What was done to prevent future issues?

After nearly a decade of frustration, the government finally decided that enough is enough. Plans are underway to replace the Phoenix system by 2026 with a new, hopefully reliable, payroll platform. The Phoenix disaster taught a hard lesson: even large institutions need rigorous testing and oversight for payroll systems. A small glitch can snowball into a national crisis. For everyday businesses, the takeaway is clear – payroll errors in Canada can escalate quickly, so use reliable software, double-check calculations, and address issues promptly before they spin out of control.

Case Study 2: CIBC’s $153 Million Overtime Oversight

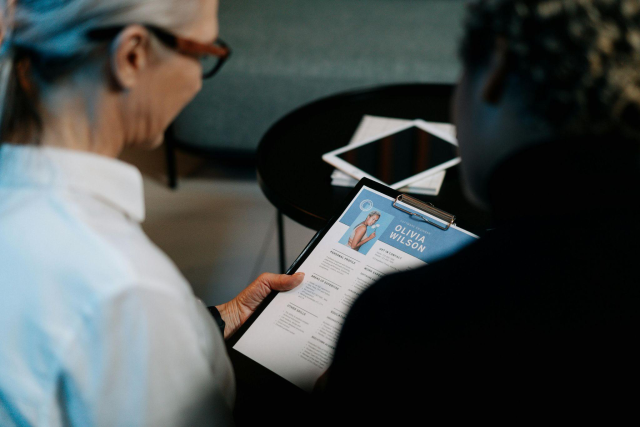

CIBC’s headquarters in Toronto. The bank faced a major class-action lawsuit over unpaid overtime, resulting in a $153 million settlement after 15 years of litigation.

One of the largest corporate payroll errors in Canada involved the Canadian Imperial Bank of Commerce (CIBC) and the mismanagement of employee overtime. The issue stemmed from CIBC’s overtime policy, which required pre-approval by managers. In practice, many front-line staff worked extra hours to serve customers but were not compensated for their overtime if it hadn’t been formally approved in advance. Essentially, the bank’s policy enabled work to be done off the clock, which violated labour standards. A CIBC teller named Dara Fresco noticed this unfair system, and in 2007, she became the representative plaintiff in a class-action lawsuit on behalf of thousands of employees.

After a protracted legal battle lasting well over a decade, the courts found CIBC had breached its overtime obligations to about 31,000 employees across Canada. Facing the likelihood of hefty damages, CIBC agreed in 2023 to settle the class-action for $153 million. The settlement money is being paid out to around 30,000 current and former tellers, personal bankers, and other staff to compensate for unpaid overtime hours over many years. Not only did this payroll mistake cost CIBC a huge sum, but it also meant years of negative press and trust issues with employees. Notably, other Canadian banks have faced similar overtime lawsuits; Scotiabank, for example, settled a case in 2014.

What can be done to prevent such issues?

To avoid legal and financial consequences, employers should implement clear and compliant overtime policies, ensure all hours worked are accurately recorded, and compensate employees for all overtime worked. Regular training for managers and the use of reliable payroll systems can further help ensure compliance with labour standards and reduce the risk of disputes.

The lesson for employers is to ensure payroll policies fully comply with labour laws and reality. If your staff end up working extra hours, you need a system to record it and make sure they get paid, period. Clear communication, proper time-tracking tools, and internal audits of timesheets can help prevent payroll errors like unpaid overtime from occurring. No company wants to be hit with a surprise multi-million dollar payout for something that was entirely avoidable.

Case Study 3: Small Businesses Fined for Unpaid Wages (Ontario)

Payroll mistakes aren’t just a big business problem. Small and mid-sized employers across Canada have also faced serious consequences for errors, sometimes with their very existence at stake. A recent example from Ontario shows how even a relatively small payroll issue can lead to legal trouble. In this case, two companies (Aemulus Corporation and Jackman Enterprises) and their director failed to pay about $85,000 in wages owed to six employees between 2019 and 2020. The employees filed complaints with Ontario’s Ministry of Labour, which investigated and ordered the companies to pay the outstanding wages. However, the employers simply ignored the orders.

Ontario authorities took them to court. The two companies and the director were hit with fines totaling $86,000 for failing to comply with the law. Under Ontario’s Employment Standards Act, ignoring an order to pay wages is an offense.

What can be done to prevent such issues?

The broader lesson for payroll errors in Canada is clear: always pay your people what they’re owed, and never ignore government orders or deadlines. Small businesses should familiarize themselves with provincial employment standards (like overtime pay rules, minimum wage, vacation pay, etc.) and set up proper payroll processes to avoid inadvertent mistakes.

If an error does happen – for example, you discover an employee wasn’t paid for overtime or a clerical mistake shorted their pay – correct it immediately. Provinces have mechanisms to file complaints anonymously, so you might not even know there’s a problem until an inspector comes knocking.

Case Study 4: Wage Underpayments at Woolworths (Australia’s $300 Million Payroll Blunder)

Payroll errors aren’t unique to Canada; companies around the world have learned the hard way how costly mistakes can be. One dramatic example comes from Australian retail giant Woolworths, which in 2019 admitted it had underpaid thousands of employees for nearly a decade. In what became Australia’s biggest wage underpayment scandal, Woolworths confessed it owed staff as much as $300 million in back pay. An internal review uncovered that at least 5,700 salaried employees (mostly department managers in supermarkets) had been shortchanged over nine years. The root cause was a payroll miscalculation: these managers were on fixed annual salaries supposedly high enough to cover any overtime, but in reality many regularly worked hours that entitled them to more pay under law than their salary provided. In short, thousands of employees were working overtime and not receiving the proper overtime or penalty rates because of wrong payroll assumptions.

The fallout was swift and serious. Woolworths’ revelation prompted a public outcry, an investigation by Australia’s Fair Work Ombudsman (the labour regulator), and accusations of “wage theft” in the media. The company’s CEO issued a public apology, stating “we have let [our employees] down” and promised to pay everyone back with interest as quickly as possible. Woolworths took a one-time charge of up to $300 million on its books to cover the remediation, which included immediate interim payments to affected staff before Christmas that year. The scandal also triggered broader industry soul-searching, with other large Australian companies auditing their own payrolls for errors. Regulators warned that companies would be held to account for such breaches even if they self-report.

What was done to prevent future issues?

Woolworths expanded its payroll review to all its business units and worked with outside auditors to identify and fix any other pay discrepancies. The company overhauled its compliance systems and committed to ensuring all managers’ salaries at least meet minimum award (overtime) requirements going forward.

The clear takeaway for employers everywhere is that payroll errors can lurk for years if you’re not careful, especially when dealing with complex overtime and salary structures. Regular audits, whether internal or by a third party, are essential. Make sure any “all-inclusive” salaries truly cover all the hours worked, or else track overtime and pay it out. What started as small calculation errors at Woolworths snowballed into hundreds of millions in liabilities. No business, in Canada or elsewhere, can afford that kind of mistake.

Why Ayali Pay Is Your Trusted Choice

You’ve seen how payroll errors in Canada and beyond can wreak havoc—from massive legal settlements to broken trust and burned finances. The good news is, you don’t have to navigate these payroll minefields alone. Ayali Pay is here to help your business get payroll right every time. We offer hassle-free payroll services in Toronto that businesses can rely on, with end-to-end support that ensures your employees are paid accurately and on schedule. Our expert team stays on top of Canadian payroll compliance rules, so you won’t lose sleep over CRA audits or missing remittances. Whether you’re a small startup or a growing company, Ayali Pay provides fully managed payroll services in Canada to eliminate errors and keep you on the right side of the law.

The true cost of payroll errors is one risk you don’t need to take. Let Ayali Pay save you time, protect your business from costly mistakes, and give you the confidence that your payroll is in the best hands. Contact us today!

Remote work has reshaped how businesses operate across Canada. The rise of hybrid and fully remote teams means companies often have employees working from different provinces and territories. Managing payroll for this distributed workforce brings new challenges. Payroll must comply with various federal and provincial laws, tax rules, and reporting requirements.

In this blog, you will find a clear and professional guide to handling payroll for remote teams in Canada. The focus is on understanding:

- The challenges of cross-provincial payroll

- Tax implications for remote employees

- The benefits of cloud-based payroll systems

This information helps businesses avoid errors, remain compliant, and provide fair, timely pay to their remote workforce.

Cross-Provincial Payroll Challenges in Canada

Canada’s federal system divides payroll responsibilities between the federal government and the provinces. This means payroll managers must navigate a complex set of regulations, rates, and remittance rules when employees work in different provinces.

1. Understanding Provincial Income Tax Withholding

In Canada, income tax is collected by both the federal government and the provinces or territories. Each province has its own tax rates and credits, which means payroll withholding must be adjusted depending on the employee’s work location.

- Federal Tax:Uniform across Canada, deducted based on CRA tables.

- Provincial Tax:Varies by province; payroll must withhold according to the employee’s physical location.

For example, Quebec has its own provincial tax system and collects provincial taxes separately from the federal government. Employers with employees in Quebec must withhold provincial income tax directly to Revenu Québec rather than the CRA.

If an employee works remotely from multiple provinces within a year, payroll systems must adapt. Employers need to:

- Track where employees are working on a day-to-day or monthly basis.

- Adjust provincial tax deductions accordingly.

- Update payroll records when employees permanently change provinces.

Payroll accuracy is critical. Incorrect provincial tax deductions may cause employees to face unexpected tax bills or refunds at year-end and could trigger CRA compliance reviews.

2. Provincial Payroll Contributions and Levies

In addition to income tax, many provinces impose payroll contributions that employers must handle.

- Health Premiums or Levies:Some provinces, such as British Columbia and Ontario, have health premiums or similar levies that must be deducted or paid by employers on behalf of employees.

- Workers’ Compensation Board (WCB) Contributions:Each province manages its own WCB program, which provides workplace injury insurance. Employers register with the WCB in provinces where their employees work and remit contributions based on payroll and industry risk.

- Employment Insurance (EI):Though EI is federally regulated, contribution rates can vary slightly based on provincial maximums.

Employers with remote teams must register with multiple provincial agencies and handle each contribution according to the province’s rules. Failure to do so could lead to penalties or delayed employee benefits.

3. Employment Standards: Vacation, Statutory Holidays, and Termination Pay

Employment standards legislation in Canada is province-specific. Payroll managers must understand and apply the correct rules related to:

- Vacation Pay:Minimum vacation entitlements vary. For instance, Ontario requires at least two weeks of paid vacation, whereas some provinces set minimums at four percent of earnings.

- Statutory Holidays:Provinces differ in the number and names of statutory holidays recognized. Employers must pay holiday pay or substitute days accordingly.

- Termination Pay:Notice periods and severance pay vary provincially and must be reflected accurately in final payroll calculations.

When managing payroll for remote workers in different provinces, payroll teams need to be familiar with each jurisdiction’s employment laws to comply properly.

4. Payroll Reporting, Remittances, and Record-Keeping

Employers must submit payroll deductions and employer contributions to the CRA and provincial authorities on schedule. Reporting includes:

- Payroll tax remittances (income tax, CPP, EI) to CRA monthly or quarterly.

- Workers’ compensation payments to respective provincial boards.

- Provincial health premiums or levies as required.

Employers must also prepare and file T4 slips that show income and deductions, ensuring they reflect the employee’s provincial location correctly.

Handling multiple provinces means managing several accounts, meeting different deadlines, and ensuring records meet local requirements. These challenges increase the administrative burden.

Remote Work Tax Implications in Canada

Remote work arrangements present several unique tax considerations that affect payroll compliance.

1. Employee Tax Residence and Work Location

In general, the employee’s tax residence and place of employment determine payroll tax obligations.

- If an employee works remotely full-time from a province, the employer must apply that province’s tax and employment rules, even if the company is based elsewhere.

- For employees who work in multiple provinces throughout the year, payroll managers should allocate wages earned in each province and apply the corresponding tax rates.

CRA guidance confirms that withholding depends on the employee’s place of work, not solely on the employer’s location.

2. Taxable Benefits Related to Remote Work

Remote employees often receive reimbursements or allowances for expenses such as:

- Home office supplies

- Internet and phone costs

- Equipment (computers, chairs, desks)

Employers must classify these reimbursements correctly. The CRA distinguishes between:

- Non-taxable reimbursements:Direct payment for reasonable business expenses that employees incur.

- Taxable benefits:Items that provide personal benefits or exceed CRA limits.

Incorrectly treating taxable benefits as non-taxable could lead to payroll errors and penalties.

Employers should:

- Keep clear documentation of expenses.

- Communicate policies on remote work reimbursements to employees.

- Adjust payroll to include taxable benefits when required.

3. Permanent Establishment and Corporate Tax Risks

A remote employee working in a province without a corporate presence could create a permanent establishment for the employer. This means the company might be subject to provincial corporate income tax.

Factors determining permanent establishment include:

- The employee’s authority to conclude contracts in the province.

- Duration and nature of business activities conducted remotely.

Employers should consult tax advisors to assess whether remote employees create permanent establishments and prepare for associated tax obligations.

4. Employment Insurance (EI) and Canada Pension Plan (CPP) Considerations

Employers must deduct EI and CPP contributions based on the employee’s province of residence. Contribution rates and maximums can differ slightly by province.

Payroll teams need to:

- Stay current on annual contribution limits and rates.

- Update payroll systems as CRA and provincial parameters change.

- Ensure accurate year-end reporting for employee CPP and EI contributions.

Cloud-Based Payroll Tools for Remote Teams in Canada

Managing multi-provincial payroll manually is complex and prone to errors. Cloud-based payroll platforms simplify the process by automating calculations, tax deductions, reporting, and compliance.

1. Centralized Management Across Provinces

Cloud payroll solutions let you:

- Manage employee records from a single dashboard regardless of their work location.

- Automatically calculate provincial tax withholdings based on employee addresses or work locations.

- Update tax rates in real time as CRA or provincial authorities adjust tables.

This centralization reduces risk, saves time, and improves payroll accuracy.

2. Automated Filing and Payment

Leading cloud payroll platforms connect directly to the CRA and provincial agencies to:

- File remittances automatically on behalf of employers.

- Generate and submit T4 slips and related year-end documents.

- Provide digital pay stubs and tax forms to employees securely.

Automation cuts down on late filings, penalties, and manual paperwork.

3. Compliance Alerts and Audit Preparation

Good payroll software monitors compliance changes and alerts payroll managers to updates in tax laws or provincial regulations.

Features often include:

- Automated audits of payroll data to catch discrepancies.

- Easy export of data for CRA audits or trust examinations.

- Record-keeping tools to demonstrate compliance during CRA payroll examinations.

4. Integration with HR and Accounting Systems

Cloud payroll platforms commonly integrate with HR management, time tracking, and accounting software. This:

- Minimizes data entry errors.

- Ensures consistency across systems.

- Enables easier tracking of remote work schedules and locations.

5. Employee Self-Service

Many platforms offer portals where remote employees can:

- Access pay stubs and tax slips anytime.

- Update personal and work location information.

- Request time off or manage benefits.

This reduces administrative questions and improves employee satisfaction.

Best Practices for Managing Payroll for Remote Teams in Canada

Effective payroll management for remote and hybrid teams requires consistent processes and attention to detail.

1. Maintain Accurate Employee Location Records

It is essential to:

- Collect initial work location data at hiring.

- Require employees to notify HR or payroll if their location changes.

- Track temporary work-from-different-province arrangements carefully.

Accurate location data ensures correct provincial tax deductions and employment law compliance.

2. Regularly Review Payroll Deductions and Provincial Contributions

Payroll administrators should:

- Conduct periodic audits of tax deductions and provincial remittances.

- Update employee records and payroll setups when employees relocate.

- Verify that vacation pay, statutory holidays, and employment standards match the employee’s province.

3. Invest in a Reliable Cloud-Based Payroll Solution

Choose payroll software that supports:

- Multi-provincial payroll with real-time tax updates.

- Automated filings to CRA and provincial agencies.

- Employee self-service and mobile access.

- Integration with HR and accounting tools.

4. Communicate Payroll Policies Clearly

Employees should understand:

- How remote work affects their payroll deductions.

- Which reimbursements are taxable or non-taxable.

- Who to contact for payroll questions.

Clear communication reduces payroll disputes and confusion.

5. Stay Current with CRA and Provincial Updates

Tax laws and employment standards change regularly. Employers should:

- Subscribe to CRA newsletters and provincial government updates.

- Attend payroll seminars or webinars.

- Consult payroll professionals when in doubt.

6. Prepare for CRA Payroll Audits and Trust Examinations

CRA conducts audits and trust examinations to verify payroll compliance. Employers should:

- Keep detailed payroll records for all employees.

- Document all payroll policies and employee communications.

- Use payroll tools that generate audit-friendly reports.

Addressing Payroll Challenges for Seasonal or Mobile Remote Workers

Some businesses have employees who work remotely but travel frequently between provinces. Examples include:

- Sales representatives

- Field service workers

- Consultants

Payroll for these workers requires:

- Accurate time tracking by location.

- Allocating wages earned per province.

- Applying appropriate tax and employment standards for each work period.

Cloud payroll systems that integrate with time tracking tools can simplify these calculations.

Understanding CRA Payroll Audits and Their Importance

CRA payroll audits, also known as payroll examinations, verify employer compliance with tax withholding and remittance requirements.

- Audits can focus on employment classification, benefit reporting, and tax deductions.

- Remote work and cross-provincial issues often attract CRA attention due to complexity.

- Maintaining accurate payroll records and using compliant payroll systems reduces audit risks.

Employers should cooperate fully with CRA during audits and use them as opportunities to improve payroll practices.

Payroll for Remote Teams in Canada: Key Takeaways

- Canada’s provincial payroll rules require employers to carefully manage cross-provincial tax deductions, employment standards, and remittances.

- Remote work shifts the employee’s work location, which often dictates payroll tax obligations.

- Taxable benefits for remote work must be handled correctly to avoid payroll errors.

- Cloud-based payroll platforms provide automation, compliance monitoring, and multi-provincial support that simplify payroll management.

- Keeping accurate employee location records and communicating payroll policies clearly is vital.

- Preparing for CRA payroll audits and examinations through sound record-keeping and software tools is essential.

Ayali Pay – Your Trusted Partner in Payroll Compliance

Ayali Pay delivers expert payroll services tailored for companies in Toronto managing remote and hybrid teams. Our all-inclusive payroll services in Toronto cover everything from CRA trust examinations in GTA to payroll audits, helping you stay compliant and confident.

With fully managed payroll service provider in Canada, Ayali Pay removes the complexity of cross-provincial payroll tax remittances, deductions, and reporting. We offer transparent, hassle-free payroll services in Toronto, designed to meet the needs of small and large businesses alike.

If you seek reliable Canadian payroll compliance and efficient Toronto payroll solutions, contact Ayali Pay today for trusted support that keeps your payroll accurate, timely, and audit-ready.

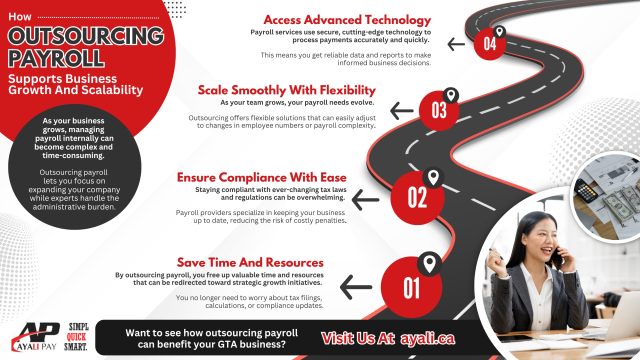

Managing payroll is one of the most critical tasks in any business. Whether you run a small company in Toronto or a growing business anywhere in Canada, how you handle payroll can affect your compliance, employee satisfaction, and operational efficiency. You might be wondering if it’s better to keep payroll management in-house or to outsource it to a professional provider. In this blog, we will discuss the pros and cons of payroll outsourcing vs. in-house management with a focus on Canadian business environments. By understanding the practical, financial, and legal factors involved, you can make a practical decision.

What Is Payroll Outsourcing?

Payroll outsourcing means hiring an external company to manage your payroll process. These providers take care of calculating employee pay, deducting taxes, filing government reports, and ensuring legal compliance with the Canada Revenue Agency (CRA) and provincial authorities. They also often handle direct deposits, benefits administration, and year-end tax forms such as T4s.

For many Canadian businesses, outsourcing payroll reduces the administrative workload and shifts the responsibility of accuracy and compliance to experts.

What Does In-House Payroll Management Mean?

In-house payroll management means your company’s staff handles payroll activities. This might involve an HR or accounting professional who processes payroll manually or using software, deducts taxes, submits payments, and manages payroll records.

In-house payroll can give you full control over your payroll data and processes. However, it requires investing in software, staff training, and dedicating time to stay current with Canadian payroll laws.

Cost Comparison

Cost often weighs heavily in the decision between payroll outsourcing vs. in-house management.

Costs When Outsourcing Payroll

Outsourcing typically comes with a monthly or per-payroll fee based on the number of employees. Fees usually cover software access, tax remittance, government reporting, direct deposit, and support.

While it might seem like an ongoing expense, outsourcing removes the need for costly payroll software purchases and updates. It also reduces the risk of errors that can result in penalties or costly corrections.

In-House Payroll Costs

In-house payroll involves buying payroll software licenses and maintaining them. You also pay salaries for employees who manage payroll and spend time training them on compliance and software use.

Indirect costs like managing mistakes, handling audits, or correcting filings can add to the overall expense. Smaller businesses without dedicated payroll staff might find that these costs quickly add up.

Compliance with Canadian Payroll Laws

Payroll compliance in Canada can be complex. The CRA enforces strict rules on payroll tax deductions, remittances, and record-keeping. Mistakes can result in audits, penalties, and interest charges.

Staying compliant means understanding both federal and provincial payroll laws, which can frequently change and require close attention.

Outsourcing and Compliance

Payroll outsourcing companies specialize in Canadian compliance. They monitor updates to federal and provincial tax laws, employment standards, and reporting deadlines. Their expertise helps reduce errors and avoid costly penalties.

Outsourcing providers often support businesses during CRA payroll audits and trust examinations in Toronto, helping navigate government reviews with ease.

In-House Compliance

When payroll compliance is managed internally, your team must keep up with legislative changes and CRA updates continuously. Payroll staff or administrators need to review new rules regularly and implement required changes in payroll calculations and reporting.

For smaller teams without specialized knowledge, this responsibility can be challenging and increase the risk of mistakes. Such errors may trigger audits, cause late filings, or result in fines, which can disrupt business operations and damage reputations.

Security of Payroll Data

Payroll involves handling sensitive employee information, including social insurance numbers, banking details, and salary data. Protecting this information from unauthorized access or breaches is a priority for any business. Improper handling can lead to data theft, legal issues, and loss of employee trust.

Outsourcing Data Security

Established payroll providers invest in secure technology, encryption, and access controls. They follow Canadian privacy laws like the Personal Information Protection and Electronic Documents Act (PIPEDA), reducing the risks of breaches from internal mishandling.

That said, it is important to select a trustworthy provider with transparent security policies and safeguards.

In-House Data Security

Keeping payroll in-house means you control data storage and access. This requires a strong internal IT infrastructure, strict access permissions, and ongoing monitoring.

Smaller businesses may find it difficult to maintain the necessary level of security without dedicated IT support.

Level of Control

Your preference for managing payroll processes impacts your choice.

Control When Outsourcing

Outsourcing shifts some control to the provider. While providers manage the day-to-day payroll activities, many offer portals for employers to review payroll reports, approve payments, and track compliance.

This reduces administrative burden but also means relying on the provider’s schedules and processes.

Control When In-House

In-house payroll gives you full authority over the process. You can respond quickly to special payroll situations, customize pay runs, and directly manage employee data.

However, full control also means full responsibility for accuracy, timing, and compliance.

Ability to Scale

As your business grows, payroll demands increase. The ease of scaling payroll affects which option is more suitable.

Outsourcing and Growth

Payroll outsourcing providers easily handle growth. They accommodate new employees, multiple locations, and different provincial tax rules without requiring extra internal resources.

This flexibility supports expanding companies with evolving payroll needs.

In-House Payroll and Growth

Growing in-house payroll requires hiring more staff, upgrading software, and possibly expanding administrative hours. This can slow down payroll operations and increase overhead costs.

Many businesses find internal payroll less flexible to adjust as rapidly as growth demands.

Technology and Automation

![]()

Payroll accuracy and speed depend heavily on technology.

Payroll Providers’ Technology

Outsourcing companies use cloud-based platforms that automate pay calculations, tax filings, and remittances. They provide employee self-service portals for payslip access and tax forms.

Providers handle software updates and security, allowing you to focus on other business functions.

In-House Technology Needs

Managing payroll in-house requires you to purchase, install, and maintain payroll software. You must apply updates, troubleshoot issues, and ensure integration with accounting systems.

Without IT expertise, technology problems can delay payroll and increase errors.

Impact on Employee Experience

Payroll is an employee-facing function. Timely payments and easy access to pay information matter.

Outsourced Payroll and Employees

Outsourcing often comes with portals where employees can securely view payslips, tax documents, and benefits information. This reduces administrative questions and builds transparency.

In-House Payroll and Employees

In-house payroll teams can address employee payroll questions directly, offering a personal touch. However, they may lack digital self-service tools, requiring manual handling of requests.

Risk and Accountability

Payroll errors can have legal and financial consequences.

Outsourcing Risk Management

Payroll providers take on much of the risk related to errors. They often offer guarantees or insurance for mistakes and assist with audit defense, minimizing your exposure.

In-House Risk Management

With internal payroll, your company is fully responsible for any mistakes, delays, or compliance breaches. This increases exposure to CRA audits and possible fines.

Which Option Fits Your Business?

Payroll Outsourcing Works Best If You:

- Are a small or medium-sized business without payroll specialists

- Want to reduce administrative tasks

- Need to comply with complex Canadian payroll regulations

- Plan to grow or operate in multiple provinces

- Prefer to use advanced payroll technology without managing software

In-House Payroll Suits You If You:

- Run a larger business with a dedicated payroll or HR team

- Have complex payroll requirements needing close control

- Possess the resources to manage compliance and technology

- Prefer direct control over employee data and payroll timing

Key Points on Payroll Outsourcing vs. In-House Management

| Aspect | Payroll Outsourcing | In-House Payroll |

| Cost | Fixed fees; avoids software and training costs | Software licenses, salaries, and training expenses |

| Control | Shared control; provider manages day-to-day | Full control and responsibility |

| Scalability | Handles growth and expansion easily | Limited by internal staff and resources |

| Data Security | Professional security systems | Internal control needed; may lack resources |

| Technology | Cloud-based platforms maintained by provider | Own responsibility for software maintenance |

| Employee Access | Employee portals provided | May lack self-service options |

Choose Ayali Pay for Your Payroll Needs

When weighing payroll outsourcing vs. in-house management, Ayali Pay offers reliable and comprehensive solutions designed for Canadian businesses. Whether you’re based in Toronto or the broader GTA, our expert payroll services and compliance support ensure your operations stay aligned with CRA regulations.

Our team provides guidance through CRA payroll and trust examinations in Toronto, helping reduce stress during audits. Ayali Pay’s all-inclusive Toronto payroll services handle everything from tax remittances to employee payments, so you can focus on growing your core business.

Choose Ayali Pay as your trusted payroll service provider in Canada for reliable business payroll solutions, payroll outsourcing, and payroll tax services. Visit our online inquiry form to contact us and schedule your free consultation—let our Toronto-based experts take payroll off your plate.

Human resources (HR) management plays an important part in every business. It covers hiring, payroll, employee relations, and following labour laws. Still, many

Canadian companies face costly problems due to HR errors. These HR mistakes that cost businesses thousands often lead to fines, legal trouble, and loss of trust. Most of these can be avoided by applying the right knowledge and procedures.

In this blog, you will learn about the most frequent and expensive HR mistakes in Canada. From miscalculating overtime pay to handling terminations improperly, knowing these risks helps you protect your business. You will also find guidance on how to keep your HR practices within the law to avoid financial losses.

Mismanaging Overtime Pay

Overtime pay issues are a common cause of HR disputes across Canada. The Canada Labour Code and provincial employment standards require most employees to receive overtime pay for hours worked beyond the standard workweek, usually 40 hours. The overtime rate is generally 1.5 times the regular hourly wage.

Incorrectly calculating overtime or failing to pay it can result in back pay owed to employees, penalties, and even lawsuits. Misclassification of workers or poor time tracking often causes these problems. Small businesses, especially, may face challenges managing overtime without proper systems.

To avoid this HR mistake that costs businesses thousands, it is important to:

- Keep detailed and accurate records of hours worked.

- Review employee classifications regularly.

- Use payroll software that automatically calculates overtime based on hours.

- Stay informed about overtime rules for the province or territory where you operate.

Applying these measures helps reduce errors in overtime payment and lowers the risk of costly claims.

Incorrect Employee Classification

Another expensive HR error is misclassifying employees as independent contractors. Some businesses try to reduce payroll taxes and benefits costs by labeling workers as contractors. However, Canadian labour laws apply tests based on the level of control, ownership of tools, and integration into the business to decide classification.

If an employee is wrongly classified, the employer may face orders to pay unpaid wages, taxes, benefits, and penalties. The Canada Revenue Agency (CRA) often investigates businesses on this issue, which can lead to audits and financial penalties.

To avoid this HR mistake that costs businesses thousands:

- Understand the criteria used to determine employee vs. contractor status.

- Keep clear documentation of work arrangements.

- Seek expert advice before making classification decisions.

- Adjust payroll and tax filings based on the correct classification.

Correct classification protects your business from future tax and legal liabilities.

Mishandling Employee Terminations

Terminating employees improperly is a major source of costly disputes in Canadian workplaces. Wrongful dismissal claims arise when employers fail to provide proper notice, severance pay, or follow correct procedures.

Key points to consider during terminations include:

- Confirm if termination is with cause or without cause.

- Provide statutory notice or pay instead of notice.

- Account for contractual or collective agreement obligations.

- Keep records of the steps taken in the termination process.

Failure to comply with these requirements can lead to lawsuits, damages, and legal fees, making this one of the most expensive HR mistakes that cost businesses thousands.

Non-Compliance with Employment Standards

Each province and territory has employment standards laws that set minimum requirements for wages, hours, vacation, leaves, and more. Businesses that do not

follow these laws risk fines and legal challenges.

Examples of common non-compliance issues include:

- Not granting paid sick leave when required.

- Failing to pay employees for statutory holidays.

- Ignoring entitlements to maternity or parental leave.

These mistakes often result from a lack of training or outdated policies. Staying informed about provincial labour standards and adjusting policies regularly helps avoid these costly problems.

Poor Record Keeping

Keeping accurate employee records is a legal obligation in Canada. Good record keeping supports payroll accuracy and protects employers in case of disputes or audits.

Employers must maintain records on:

- Hours worked.

- Pay and deductions.

- Leave taken.

- Terminations and disciplinary actions.

Failure to keep proper records can result in penalties and weakened legal defences, adding to the cost of HR mistakes that cost businesses thousands.

Inadequate Workplace Health and Safety Practices

Workplace safety rules are enforced strongly across Canada by provincial agencies like Ontario’s Ministry of Labour or WorkSafeBC. Non-compliance can lead to fines, work stoppages, and higher insurance premiums.

Common safety errors include:

- Skipping required safety training.

- Not investigating incidents thoroughly.

- Ignoring employee concerns about hazards.

A workplace without proper safety measures risks accidents, compensation claims, and loss of reputation—all of which can be expensive.

Errors in Employee Benefits Administration

Benefits like group insurance, pension plans, and paid time off involve strict rules. Mismanaging benefits plans or contributions risks penalties and employee dissatisfaction.

For example, mistakes in Canada Pension Plan (CPP) or Employment Insurance (EI) remittances can trigger CRA audits. Poor benefits management also affects employee morale and retention.

Avoiding this HR mistake that costs businesses thousands requires understanding benefits regulations and managing them with care.

Insufficient Training for HR and Managers

Many HR mistakes result from a lack of training for HR staff and managers. When those responsible for hiring, managing, and terminating employees lack a solid understanding of employment law and best practices, the risk of errors increases significantly. Managers may unintentionally violate labour laws, mishandle employee relations, or misinterpret company policies. These mistakes often lead to legal disputes, fines, and lost productivity.

Beyond the legal aspects, inadequate training can also harm workplace morale. When managers are unsure how to handle conflict, performance issues, or complaints properly, employees may feel unsupported or unfairly treated. This can lead to higher turnover rates, absenteeism, and decreased engagement—all of which carry financial consequences.

Regular and targeted training sessions focused on labour standards, payroll regulations, workplace harassment, and termination procedures help reduce these risks. Training should be updated frequently to reflect changes in legislation and emerging best practices. Additionally, companies can consider using external experts to deliver workshops or provide ongoing support, ensuring HR teams and managers stay informed.

Ignoring Human Rights and Inclusion Requirements

Canada’s human rights legislation is designed to protect employees from discrimination and harassment based on protected grounds such as race, gender, age, disability, religion, and more. Ignoring these legal obligations or failing to take complaints seriously can result in costly human rights claims against businesses. Such complaints may lead to financial penalties, mandatory corrective actions, and significant damage to the company’s reputation.

A common HR mistake is neglecting to accommodate employees’ needs as required under human rights laws. For example, failing to provide workplace adjustments for disabilities or ignoring requests for religious accommodations can trigger legal challenges. Employers are expected to act promptly and reasonably to address these needs, and create an inclusive environment where all employees can perform their best.

Furthermore, overlooking harassment complaints, whether related to bullying, sexual harassment, or discrimination, can expose the business to costly lawsuits and workplace disruption. Employers must have clear policies, accessible reporting mechanisms, and follow-up procedures that protect complainants and ensure fair investigations.

Accessibility requirements also play an important role. Businesses must ensure that their facilities, tools, and communication methods do not exclude individuals with disabilities. Non-compliance with accessibility standards can lead to fines and increased liability.

How to Reduce Risks and Avoid HR Mistakes

Businesses can limit costly HR mistakes by taking the following steps:

- Use payroll and HR systems that accurately manage overtime, classifications, and statutory deductions.

- Keep thorough and organized employee records.

- Provide ongoing training to HR staff and managers on labour laws and company policies.

- Consult legal or HR experts before significant actions such as terminations or reclassifications.

- Monitor changes in federal and provincial employment standards.

- Maintain clear, written policies reflecting current laws.

Applying these steps helps businesses avoid financial losses and maintain workplace fairness. The most frequent HR mistakes that cost businesses thousands in Canada include mishandling overtime pay, misclassifying workers, improper terminations, non-compliance with employment standards, and poor record keeping. Other costly issues involve workplace safety, benefits administration, insufficient training, and ignoring human rights rules. By improving HR procedures and keeping policies updated, businesses can reduce the risk of penalties, lawsuits, and reputational damage.

Why Ayali Pay Is Your Trusted Partner for Payroll and Compliance

Managing payroll in Toronto can be difficult. Ayali Pay offers expert payroll services in Toronto, designed to help businesses stay within the law and avoid costly HR errors. Our services include CRA payroll audit and CRA payroll examination services in Toronto, offering expert assistance during government reviews.

With Ayali Pay, you receive fully managed payroll services in Canada, relieving your business of administrative burdens. Whether you need payroll services for small businesses in Toronto or need hassle-free payroll services in GTA, Ayali Pay delivers reliable support.

Schedule your free consultation today through our online form and discover how our trusted Toronto payroll solutions can help protect your company from costly mistakes.